Keep A Steady Hand On The Tiller

I hope this finds everyone doing well and, importantly, avoiding the day-to-day in the financial press.

If you’ve looked, however, the headlines might have raised concerns. The following are examples:

“If your retirement savings are invested in the stock market, you lost big today”

“The stock has plunged”

What should an investor do?

First, remember that the financial media thrives by writing colorful headlines, which draw eyeballs and hence sell advertising.

The best advice, however, might have come from my 10 year old son, Jack, a few weeks ago. On the same day that the stock market dropped by over 500 points, he was telling me about his day on the water in a sailing class.

Jack said,

“Dad, today the wind was strong and it was scary. I remembered what my teachers said though, kept calm, and just stayed on course.”

Staying composed when storm clouds bring bad weather is not easy.

But…

Just as keeping a steady hand on the tiller and staying calm is the key to reaching a port safely, avoiding the urge to make changes in volatile markets is the key to long-term investing success.

Over the years, I’ve written many commentary pieces after large market drops (concerns over 50 year floods come about every 5 years).

My message is always the same.

Make sure you have a solid long-term plan (emphasis on long-term) that is prudently diversified and designed to meet your goals, not the investment models of others.

I know it is hard to avoid getting emotionally drawn in by market headlines, but try to remember that investing should be a means to an end, not a competition.

Try to stay anchored on your plan versus getting caught up in the day-to-day.

This is difficult and many investors make poor decisions at the wrong time (professional investors included).

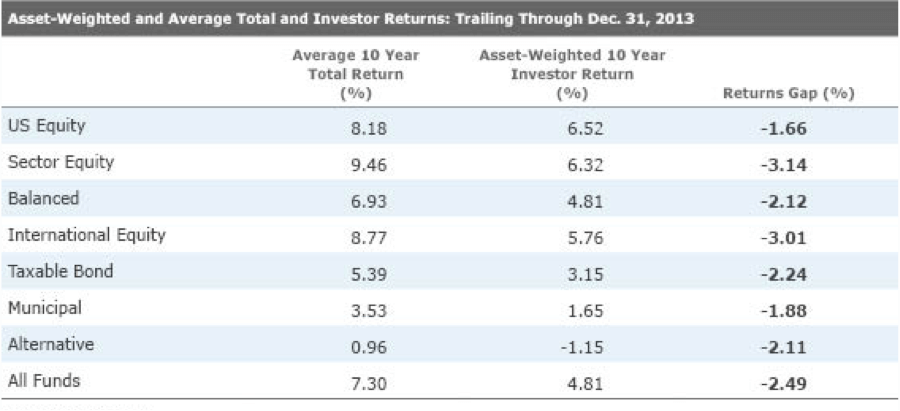

Highlighting this, Morningstar recently analyzed the difference between the average return of mutual funds and the actual returns of investors. According to their research, the 10 year return of the average U.S. equity fund for the period ending 12/31/13 was 8.18%.

What was the average return of U.S equity fund investors over this same time period?

Unfortunately, only 6.52% (click here for the full report and see the below chart).

As Morningstar wrote,

“Investors tend to get in and out of an asset class at the wrong time.”

What can we do to be better investors?

If you do not already have a written Investment Policy Statement (IPS) or long-term plan, consider getting one.

At Fiduciary Wealth Partners, we work with clients to memorialize long-term investment goals. Based on these long-term goals, we then help investors establish IPS risk, liquidity and asset allocation targets that are designed to meet their objectives, all before we invest (emphasis on “before”).

If you write down specific goals and targets prior to investing, it is easier to stick to a plan.

If you don’t, it is difficult for anyone to avoid letting the emotion or the competition of the market take over.

We believe that an IPS should set maximum and minimum risk control ranges around long-term asset class targets. This anchors client portfolios on risk controls, which helps avoid big bets that could turn into big mistakes.

As an example, a moderately risk-adverse investor might consider having a long-term target of 60% in equities with a low end range of 55% and a high end range of 65%. If the market drops and the equity allocation goes below the minimum range, the IPS mandates that an investor buy. On the other hand, if the market has run up significantly, the maximum IPS ceiling forces selling to take some chips off the table.

I do not know how this current market will unfold over the next few weeks or months (no one has a crystal ball), but sticking to a disciplined plan is the key to investment success.

The old saying is,

“Strategies don’t blow up, people do.”

Beyond the Morningstar research mentioned above, one of the best examples of potentially lost opportunities might be from the 2008-2009 financial crisis.

In March 2009 the S&P 500 hit the “world is going to end” level of 666.

If you had an IPS in place, and someone to help you stick to your written plan (it is hard to keep emotions in check on your own), you would have found yourself below your minimum allocation target to equities. All investors felt great unease during this period, but IPS documents mandated that investors buy equities to rebalance back to long-term targets.

The market continued to experience large swings after this period but, even after what the financial press is currently calling “a rout”, the S&P 500 closed yesterday at 1,970. A gain of over 195% over from the 666 low in 2009.

To help “keep calm and carry on”, below are a few simple recommendations to consider.

Have A Long-Term Plan That Is Designed to Meet Your Individual Goals

– Investing should not be a competition

– Unless your goals have changed, do not throw out a good plan with a bad market

Set Investment Policy Max. and Min. Ranges For Various Types of Investments

– Everyone will be wrong from time to time

– Set limits on the upside and downside before you invest

– Max. and Min. ranges should help to control emotions and hence risk

Be Contrarian and Don’t Follow the Herd

– Wall Street and Federal Reserve predictions are often wrong (see “Ground Hog Day“)

– Large flows into and out of an asset class are often a sign of a top or bottom

Place a Premium on Liquidity

– Don’t invest in illiquid investments unless the rewards being offered are compelling

– Liquidity and optionality are not linear – When you need it, you need it

Understand True Risk Exposures of All Investments

– Strategies based on complex models and investment theories may not hold up when you need them the most

– Remember Long-Term Capital, Lehman Brothers, etc.

Remember Fees and Taxes

– Strategies that promise outsized returns or downside protection often come with high fees and high taxes (see “What Would Yale Do If It Was Taxable“)

Don’t Be Sold

– If you don’t fully understand it, don’t buy it

– Always ask for complete transparency on all risks and conflicts.

Keep It Simple – Slow, Steady, and Boring Often Wins

– As with many things, the tortoise consistently beats the hare, and often with much more peace of mind and less heartburn, which makes it easier to stick to long-term plans.

As my son has learned on the water, conditions are often out of our control and can change rapidly.

Be prepared and stay broadly diversified.

Don’t reach for returns.

Focus on your long-term plan and don’t be sold the hot investment strategy.

Sticking with the boating theme, make sure your “ventures are not in one bottom trusted” (Merchant of Venice – Shakespeare).

Market storms are part of the weather cycle.

And..

History consistently teaches us that true long-term investors (who will in practice come in for the most criticism – John Maynard Keynes) will continue to be rewarded for keeping a steady hand on the tiller.

Related Reading:

- Preston McSwainhttps://fwpwealth.com/author/preston/

- Preston McSwainhttps://fwpwealth.com/author/preston/

- Preston McSwainhttps://fwpwealth.com/author/preston/

- Preston McSwainhttps://fwpwealth.com/author/preston/